Examine your state's exam material outline to see the format of the examination. In about half the states the insurance fundamentals info and the law information are two different examinations. And you need to get a passing score on both the insurance basics test and on the related law test to pass.

Recognizing with the exam format and point allocation of the test assists you to understand where to focus your study time. Getting Your Insurance License After you receive your death results, you will require to submit the license application, and any other necessary documents, and pay the required costs to get your insurance license and end up being an insurance coverage representative.

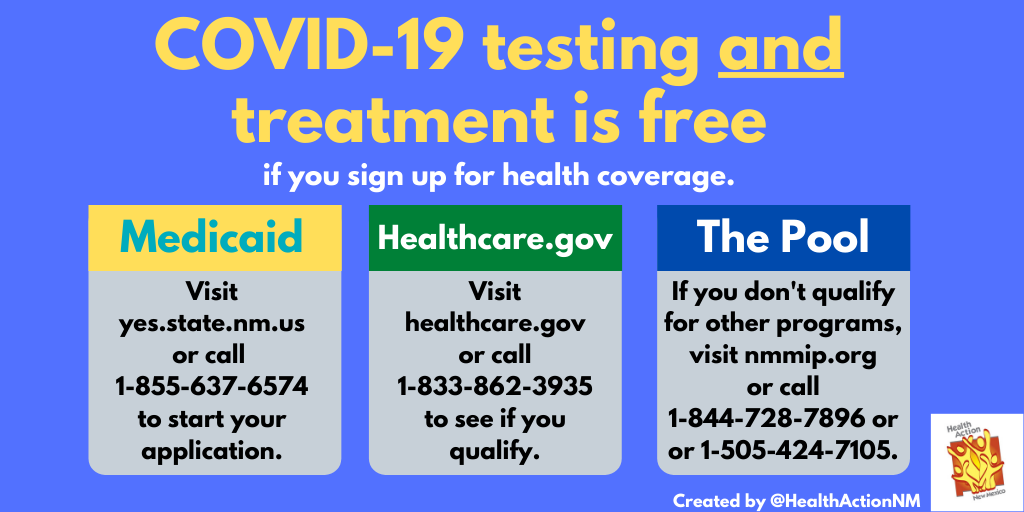

Why are we making this limited-time deal? Numerous individuals are losing their tasks due to the corona virus break out and now have time to check out a part of our course while thinking about a new profession! Insurance coverage representatives, also referred to as insurance coverage producers, sell different types of insurance policies to customers and need to hold a license to transact insurance coverage.

3 Easy Facts About How To Be The Best Insurance Agent Explained

Our courses prepare students to pass their state insurance examination on the first effort! This is being used ONLY for Home & Casualty Representative/ Producer courses. Residential or commercial property & Casualty representatives or manufacturers offer insurance policies for individual and industrial lines including residential or commercial property and liability. Examples include Homeowners policies, Personal & Commercial Vehicle coverage, Industrial Home, and Commercial General Liability policies.

com with FREE COURSE TRIAL in the subject line. In the email, please define your state of legal home and Cindy will register you in the 14-day trial and send you your logon info.

Insurance belongs to the world today, and it's not disappearing at any time soon. We all count on insurance policies to secure our positions financially. Organizations need insurance coverage as much as people do. Insurance representatives prepare policies that protect their customer's interests. Here's how to become an insurance coverage agent: Ad Learn more about the insurance field in basic.

6 Simple Techniques For How To Become An Insurance Agent In Ohio

Earn a bachelor's degree, or even simply a partner's degree, in finance, business or economics. Although not all insurance provider require their agents to have a post-high-school degree, having one will put you ahead of the competitors. Gain experience operating in sales or in the insurance coverage field. This will make you more certified upon going into the task market (how to become licensed insurance agent).

Many states require insurance agents to have a task in the field prior to being qualified for a main license. Get licensed. Learn your state's licensing requirements. Although licensing requirements differ from one state to another, all representatives should be certified by the state in which she or he lives. It is therefore essential that you find out the specific certification requirements for your state.

Register for the pre-licensing training appropriate for your position and state. An evaluation course for insurance coverage agents will help you prepare for your state's licensing exam. Organizations, like the American Institute for Chartered Home Casualty Underwriter (AICPCU) and the Insurance Coverage Institute of America (IIA), offer many specific and basic accreditation programs accepted by numerous states [AICPCU] (what is an insurance agent).

Some Ideas on How To Become A Medicare Insurance Agent You Should Know

Continue taking courses to stay up to date with any changes in the regulations. Numerous states require insurance representatives to take ongoing education classes as often as every 2 years [Education-portal].

As an insurance coverage agent, you are offering security for your customers' most valuable possessions. To become an insurance representative, you need a minimum of a high school diploma. how to become licensed insurance agent. Nevertheless, further education can assist you succeed in this business. The typical income for an insurance coverage representative was $46,770 in 2011, according to the U.S.

You require a high school diploma or comparable and an insurance license from your state to work as an insurance coverage representative. The licensing requirements differ in between states however they typically need that you take an insurance course plus pass a test offered by your state. You need a license for each different type of insurance coverage you sell, so if you want to sell both life and medical insurance, you require 2 various licenses.

The Best Guide To What Does It Take To Become An Insurance Agent

The U.S. Bureau of Labor mentions that more than one-third of sales agents have a bachelor's degree. A range of significant fields of study are suitable ffor somebody thinking about insurance coverage sales. For example, a graduate in threat management will have a much better initial understanding of insurance concepts. Psychology and marketing graduates might have a better understanding of human habits and be much better prepared as salesmen.

Some academic degrees are helpful for insurance coverage representatives, as well. Law graduates will understand the legal procedure for large estate transfers, for example, making them better for high-net-worth life insurance coverage clients. Organization school graduates may be better able to communicate with entrepreneur and accountants. In addition, an academic degree looks remarkable on your marketing and can help you bring in customers.

These titles show that someone has a skilled level of knowledge in her field. For instance, life insurance coverage representatives value the Chartered Life Underwriter classification while property insurance agents desire the Chartered Property Casualty Underwriter designation. To make an expert classification, you should take a series obviously and pass a standardized test from the designation board.

The 4-Minute Rule for What Is It Like To Be An Insurance Agent

By Nicole Manuel Updated June 29, 2018 Taking the ideal insurance courses can make the difference between landing an insurance job with a major national firm and not acquiring a license to sell insurance coverage within your state. According to the Bureau of Labor Stats, insurance coverage representatives earn an annual average wage surpassing $49,990.

A minimum requirement to become an insurance coverage representative is usually a high school diploma or its comparable. Although no college degree is necessary, numerous companies need or choose a degree. Getting a degree in a relevant subject such as financing, economics or service administration will help make you better to potential companies.

Insurance coverage salesmen are generally expected to have 3 to 5 years of related experience. This experience can be gotten through insurance, banking, finance or direct sales experience. Numerous insurance provider provide internships or training positions to aid in the advancement of abilities required for insurance coverage brokering success. Such skills can consist of public speaking, team building, and marketing.

The 4-Minute Rule for How To Become An Insurance Agent In Florida

The most crucial https://gumroad.com/paleri70q5/p/9-easy-facts-about-what-is-it-like-to-be-an-insurance-agent-described course for a brand-new insurance coverage agent is the license training course. Despite the type of insurance coverage you sell, you should be registered as an insurance coverage agent with your state. To do so, you must sign up for a state-approved training course in the insurance coverage type of your choice and take a proctored test. how to become an insurance sales agent.

As soon as you pass the exam you are permitted to sell insurance in your state. Every two years after you pass the examination you need to report to your state's insurance coverage department a continuing education course you have taken in order to keep your license. Due to the fact that many insurer diversify into other types of insurance coverage, you might be needed to hold multiple insurance licenses.

These representatives may be needed to get monetary accreditations in monetary planning or as an underwriter to advance within the company.